Musings of an ex VC

By Mike McCormick, Venture Partner at Greatpoint Ventures

What would you tell your younger self when he was starting out in venture?

Pursue investments that can realistically get done — and find 1-2 spaces where you can shine. GPV hadn’t made any insuretech investments before I joined, but we had done some in healthcare and fintech. As a result, insuretech was close enough to what we knew, but new enough to the firm that I could be a go-to person for the space. Since I joined, we’ve done at least five insuretech investments, all of which I’ve either sourced or worked on. It’s helpful to develop areas of expertise that nobody else in the firm already owns, but which are compatible with the firm’s existing theses.

Make real friends, not just connections. Real relationships give you an edge, plus it's just much more gratifying to do business with people you actually like and have built bonds with. A friend will send you a deal before sending it to other firms and will be real with you about red flags and deals to avoid. Working with a “connection” will always feel much more transactional and zero-sum.

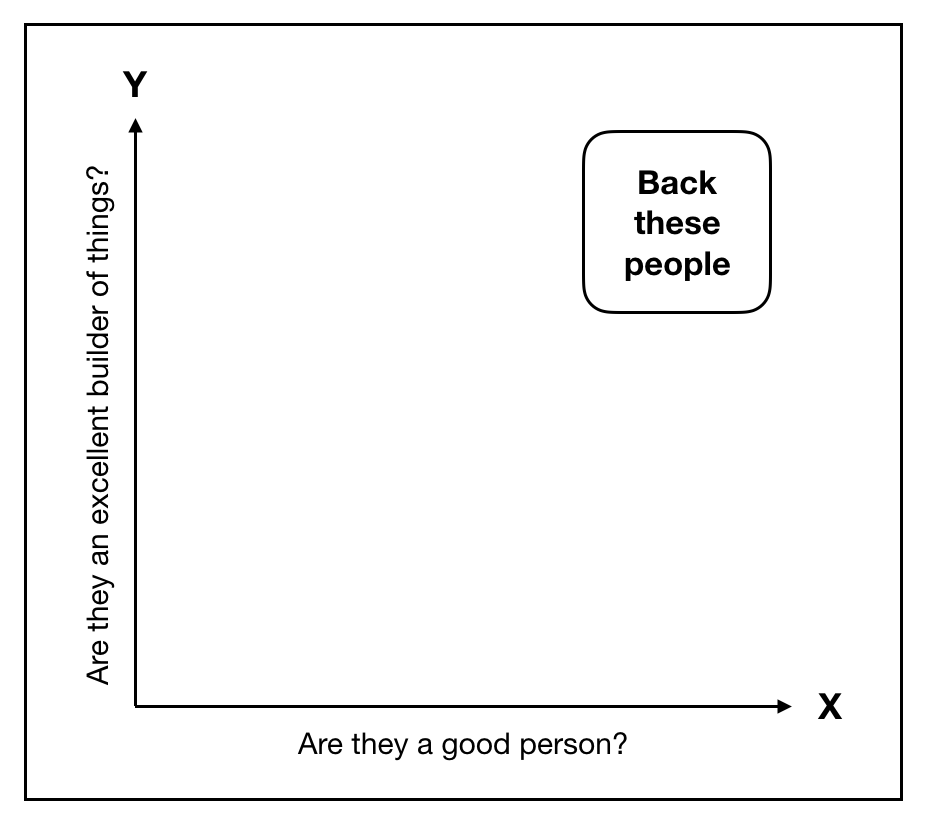

Back the “X/Y People.” Imagine plotting the people you know on a graph. The X axis measures if somebody is a good person (Are they kind? Thoughtful? Ethical? Do you feel good when you’re around them?). The Y axis measures if somebody is an excellent builder (Are they audacious and talented enough to make a major contribution in their space?). If you work to find people who are way up in the top right corner of the graph, and support them unconditionally, good things will happen for you.

You’ll be judged on your outcomes. The people who rise up the ranks in venture are those who source and pound the table for the investments that end up being really big wins. At the end of the day, you’ll be judged primarily on whether you contributed to your firm’s great investments.

Be a “glue person”. They call an athlete who contributes to their team’s success in non-obvious ways “a glue guy” or “glue girl.” Glue people are core to their team’s culture even if they aren’t the leading scorers. Of course you want to “make it rain” right away, but as you build up to that, you can become irreplaceable by being a glue person.

Find a senior ally. It’s important to find a senior partner who can help you succeed. One of GPV’s Partners in particular has become my closest venture mentor and a friend. He and I are interested in many of the same industries and theses, and we have similar instincts about what makes an entrepreneur and a company exciting. We’ve made many of our best investments together and I couldn’t have gotten where I am without him.

What was different from what you initially anticipated, going into venture?

It’s not always glamorous. The best part of the job is connecting with so many brilliant people who are building amazing things, and then occasionally investing and putting your own energy behind them. In between those moments, there’s a lot of unsexy stuff like email, looking at documents, futzing around in excel, talking to lawyers, and more email. (Actually for the record, I usually really like talking to our lawyers — great folks—shout out to Jana!)

VCs are humans. We all have flaws and biases and emotions. We feel FOMO, which smart founders use to their advantage. We let ourselves get arbitrarily anchored to prices and ownership targets. We get more excited about companies when we know other investors are looking at them, even though we should be able to evaluate deals on their own merits. Like everybody else, we’re all just quirky and flawed humans.

It’s hard to not compare yourself to others. If you spend time in VC and startups, a bunch of people you know (some of them younger than you) will become insanely successful and wealthy. It’s easy to ask “Why am I not doing as well as him or her?” I find I’m so much happier when I ditch the comparative self-judgement and focus on feeling gratitude for what I have. We’re all so lucky, even if we don’t become zillionaires by 30. You should work your butt off and swing for the fences, but don’t let your personal happiness depend on whether you make the Midas List.